Project Overview

The USD 313 school board approved a resolution to move forward with an 8 million dollar bond election for facility enhancements. A public vote for USD 313 patrons will take place in person on April 4th, 2023, with advance voting starting March 27th. See below for the scope of the project, financial details, images of the proposed project, and frequently asked questions.

High Level Details

Ad Astra Academies Learning Space

District Leadership and Support Staff Consolidation

Indoor Activity Facility

Elementary Playground Enhancements

Cost to the taxpayer

This project can be completed without raising the bond and interest mill levy.

How are we able to complete this project with no effect on the bond and interest mill levy?

The district refinanced the last two bonds at a significant savings (4% to 2.89% and 3.37% to 1.31%), additionally state aid on those bonds went from 25% to 36%. In addition our valuation has increased over 3% annually the past 10 years.

Below are the polling locations by precinct for the USD 313 Election.

Voters Residing In Precincts

10, 11, 17, 22 H104, 23, 23 Exclave, 24, 25, 27, 31, 32, 33, 34, Clay North Township, Clay North Enclave, Grant Township and Reno North Township

Will Vote At

Kansas State Fairgrounds Encampment Building

2000 N. Poplar Hutchinson, KS 67502

Voters Residing In Precincts

Clay South H102-1, Clay South H104, Clay South H114 and Valley Township

Will Vote At:

Bethany Church of the Nazarene

408 N, Kent Rd

Hutchinson, KS 67501

Voters Residing In Precincts

28, 28 Exclave

Will Vote at:

Dillon Nature Center

3002 E. 30th Ave

Hutchinson, KS 67502

Voters Residing In Precincts

Little River, Medora and Harvey County

Will Vote At:

Buhler Wellness Center

525 Parkside Dr.

Buhler, KS 67522

Needs that will be met with this project

Ad Astra Academies

Facility which will include

Flexible learning classroom

Teacher offices

Reception area with secure entry

Student bathrooms

Life skills space

Burkholder Administration Center Expansion

Consolidate leadership and support services

Integrate all district services on one campus (administrative, curriculum, technology, finance, food service, transportation, maintenance, printing services)

Multipurpose meeting room

Professional development

Community storm shelter

Community event space

Board of Education room

Reception area with secure entry

Enhanced Elementary Playgrounds

Replace deteriorated surfaces

Update equipment

Increase accessibility

Expand green space

Indoor Facility

Large, open activity space with turf surface

Uses include:

Band, flag corps, dance

PE classes

Athletic space

Large district meetings

Community youth sports

Community event space

Impact of YES or NO vote

What does a YES vote mean?

Meet the needs listed, including:

Safe, student approved space for Ad Astra Academies

Consolidation of district administration and support services

Improved, safe, and accessible playgrounds

Indoor activity facility available for the school and community

Large meeting space available for school district and community use

A stable bond and interest mill levy

What would a NO vote mean?

An approved Ad Astra Academies space would have to be paid for out of capital outlay funds

Playground enhancements and upgrades would need to be fundraised, paid for out of capital outlay, or neglected

BAC upgrades would need to be paid of out of capital outlay or neglected

**Utilizing capital outlay for these projects will impact our ability to maintain and improve:

HVAC

Turf

Technology

Vehicles

Furniture

Uniforms

Financial Analysis

Buhler USD 313 public finance consultant, Raymond James provided us with the following analysis us of our financial position.

"The District is able to issue new General Obligation Bonds to finance the proposed improvement projects without increasing the mill levy used to repay both the outstanding bonds and proposed new bonds. This “no mill levy increase bond election” is possible due to several favorable factors. The District has taken advantage of recent record low interest rates and refinanced portions of the outstanding bonds. In fact, the low interest rates allowed the District to capture a total savings of $3,635,577 on bond refinancings in 2020 and 2021. The portion of bonds refinanced in 2020 lowered rates from 4.00% to 2.89%. In addition, a separate portion of bonds that was then refinanced in 2021 lowered the rates from 3.37% to 1.31%. This savings lowers the annual debt service payments on the outstanding bonds which, in turn, allows room for payments on new bonds to be made without increasing the mill levy needed to repay all outstanding bonds. Another positive factor for the District is that the State Aid percentage to repay the outstanding bonds, which were authorized at an election on June 5, 2012, has increased from 25% in 2012 to 36% in 2023. The higher amount of State Aid on outstanding bonds helps take pressure off of local taxpayers and this allows for new bonds to be issued without an increase in the mill levy rate. Any bonds approved at an election after 2015 receive a lower percentage of State Aid, but it has been favorable for the District to see the State Aid percentage increase on the current outstanding bonds. The District has also had solid growth in the assessed valuation, or tax base, of the District. An increasing assessed valuation also allows for new bonds to be issued without requiring an increase in the mill levy. Finally, even though interest rates are slightly higher today than the record lows set two years ago, the borrowing cost or interest rates for the proposed new bond issue are very favorable from a historical perspective. Interest rates have been higher 80% of the time since 1990 and favorable interest rates help keep the annual debt service payments low. This too allows for new bonds to be issued without a mill levy increase. The District is in a fortunate position to be able to make meaningful improvements without requiring an increase in the tax rate on local taxpayers. "

Bond Market Outlook

After watching interest rates increase throughout most of 2022, the bond market is off to a good start in 2023. In fact, interest rates declined significantly after today’s release of the Consumer Price Index (CPI), which showed inflation retreating for the sixth month in a row. The yield on the 10-Year U.S. Treasury Note, as shown below, rallied after the CPI report and declined by 11 basis points (0.11%) this morning, which is a significant decline for one day. Interest rates on municipal bonds tend to follow changes in the U.S. Treasury market, so this is favorable for issuers that have upcoming bond sales or bond elections.

In regards to interest rates on municipal bonds, the Bond Buyer 20 Bond Index shows that interest rates have been higher 82.3% of the time since 1990. While we are currently higher than the record low interest rates et in 2020, it is still a very favorable time to finance new projects or potentially refinance outstanding bonds.

I hope this update is helpful and please let us know if we can be of any assistance.

GREGORY M. VAHRENBERG-Public Finance Consultant for USD 313

Update from March 13th.

Late last week the collapse of Silicon Valley Bank, followed by the closure of Signature Bank on Sunday, caused investors to flock to the safety of the U.S. Treasury bond market. This resulted in a sharp decline in rates as the yield on the 10-Year U. S. Treasury Note dropped from 4.00% last week to its current yield of 3.54%, which is its biggest single-day decline since 1987. Since municipal bond rates tend to follow changes in the U.S. Treasury market, the yields on tax-exempt municipal bonds have improved significantly as well.

GREGORY M. VAHRENBERG-Public Finance Consultant for USD 313

Frequently Asked Questions

What is the scope of this project?

This project encompasses many upgrades including new construction. Included are playground enhancements and accessibility at all elementaries, paving two parking lots, sidewalks, and consolidation of student/staff support services. The new construction would include space for our growing Ad Astra Academies, community room/boardroom, public storm shelter, professional development, offices, and an indoor activity facility.

How does a new building affect our ability to enhance staff compensation?

Staff salaries and facilities are both priorities and do not compete against each other. The bond and interest fund is not legally allowed to be used for staff salaries.

How does maintaining a new building affect our ability to maintain current facilities?

In the last two years, we have created a facilities plan. We have committed to stay on track with HVAC replacement, painting, etc. Additionally, we have hired contracted services to enhance the cleaning of our facilities.

How will the money for playground enhancements be distributed?

We will assess needs for all three playgrounds, collaborating with stakeholders–building Site Councils/PTO, administration, and building staff. Our building administrators and lead stakeholders for each campus will work together on a systemic plan to enhance all three playgrounds.

What happens to Ad Astra Academies if the bond doesn’t pass?

If the bond doesn’t pass, we will still need to build a facility for Ad Astra Academies. Capital Outlay would have to be the funding source for this facility. This could significantly affect or delay other improvement projects.

Is this a financially prudent time to secure a new bond?

While it is difficult to ignore that interest rates today are higher than the all-time record lows set in August, 2020, it’s still a very favorable time to issue bonds for new projects. The Bond Buyer Revenue Bond Index shows that interest rates have been higher 84.7% of the time since 1990 and the current yield on a 20-year maturity of a “AAA” rated General Obligation Bond issue is 3.38% according the Municipal Market Data (MMD) Index. While these are not record low levels, it is still a very favorable time to finance new projects at attractive interest rates.

What is the effect on our mill levy if this bond passes or does not pass?

The financial analysis ran by Raymond James, Public Finance Consultant, indicates this project can be completed with minimal effect on the bond and interest mill levy. During the past two years we were able to refinance two previous bonds for a significant savings. This savings allows for new bonds to be issued without increasing the mill levy specifically in relation to this project. We can harness these savings to fund this project with minimal impact on the bond and interest mill levy OR wait until 2037 and potentially pay off the previous bonds one year early.

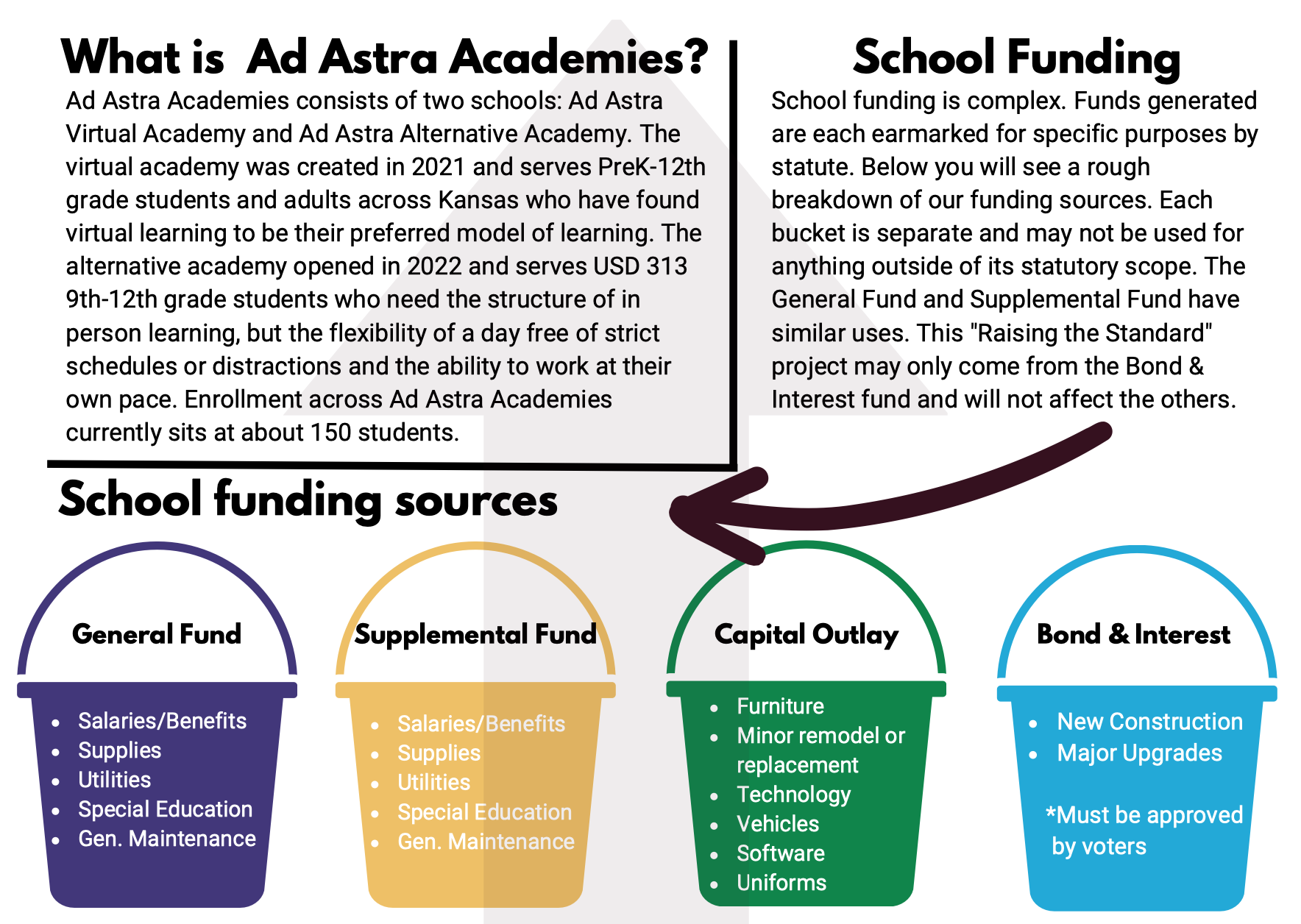

The overall mill levy is determined by the general fund, supplemental general fund, capital outlay, and bond and interest. The supplemental general fund is impacted by student headcount, valuation, and state aid.

How does this school project benefit the community?

Communities and schools have a symbiotic relationship. When one thrives, so does the other. Community members and families will enjoy updated and more accessible playgrounds, large indoor activity space, a community meeting room, and a public storm shelter.

Attracting and retaining staff and students through relationships, programs, opportunities, and facilities is a priority. We continue to grow as we hold true to the saying: progressive ideas and traditional values.